In today’s fast-paced business environment, accurate financial reporting, regulatory compliance, and operational efficiency are more important than ever. Leveraging the right financial consolidation software can transform these processes, giving organizations the tools they need to automate data aggregation, reconcile intercompany transactions, and streamline reporting workflows. Result Lane offers industry-leading consolidation solutions that help finance teams reduce errors, improve compliance, and gain real-time insights into corporate performance. This guide explores the essential factors companies should consider when choosing the right financial consolidation software for their needs.

Why Financial Consolidation Software Matters

For businesses with multiple subsidiaries, departments, or international operations, financial consolidation is a complex process. Traditional methods—manual spreadsheets, disparate systems, and paper-based approvals—are time-consuming and prone to errors. These inefficiencies can lead to inaccurate financial statements, regulatory risks, and delayed reporting.

Financial consolidation software centralizes the entire process, providing automation, standardization, and audit-ready reporting. Organizations can confidently consolidate data from multiple sources, eliminate intercompany discrepancies, and maintain compliance with accounting standards such as IFRS and GAAP. Platforms like Result Lane simplify these processes, allowing finance teams to focus on strategic decision-making rather than manual data entry.

Key Features to Look For

When evaluating financial consolidation software, businesses should prioritize solutions that deliver accuracy, efficiency, and compliance. Key features include:

### 1. Automated Data Aggregation

The ability to automatically import data from ERP systems, accounting platforms, and other financial sources is critical. Automated aggregation reduces manual errors, ensures consistency, and saves significant time during the consolidation process. Result Lane’s software supports seamless integration with multiple systems, enabling finance teams to access accurate data in real time.

2. Intercompany Reconciliation and Eliminations

Intercompany transactions are often a source of errors and compliance issues. Look for software that automates reconciliation and elimination of intercompany balances, ensuring that consolidated statements accurately reflect the organization’s financial position.

3. Regulatory Compliance Support

Compliance is a top priority for any organization. The best financial consolidation software includes built-in support for international and local accounting standards, such as IFRS, GAAP, and other statutory requirements. This ensures that reports meet legal and regulatory obligations while minimizing risk.

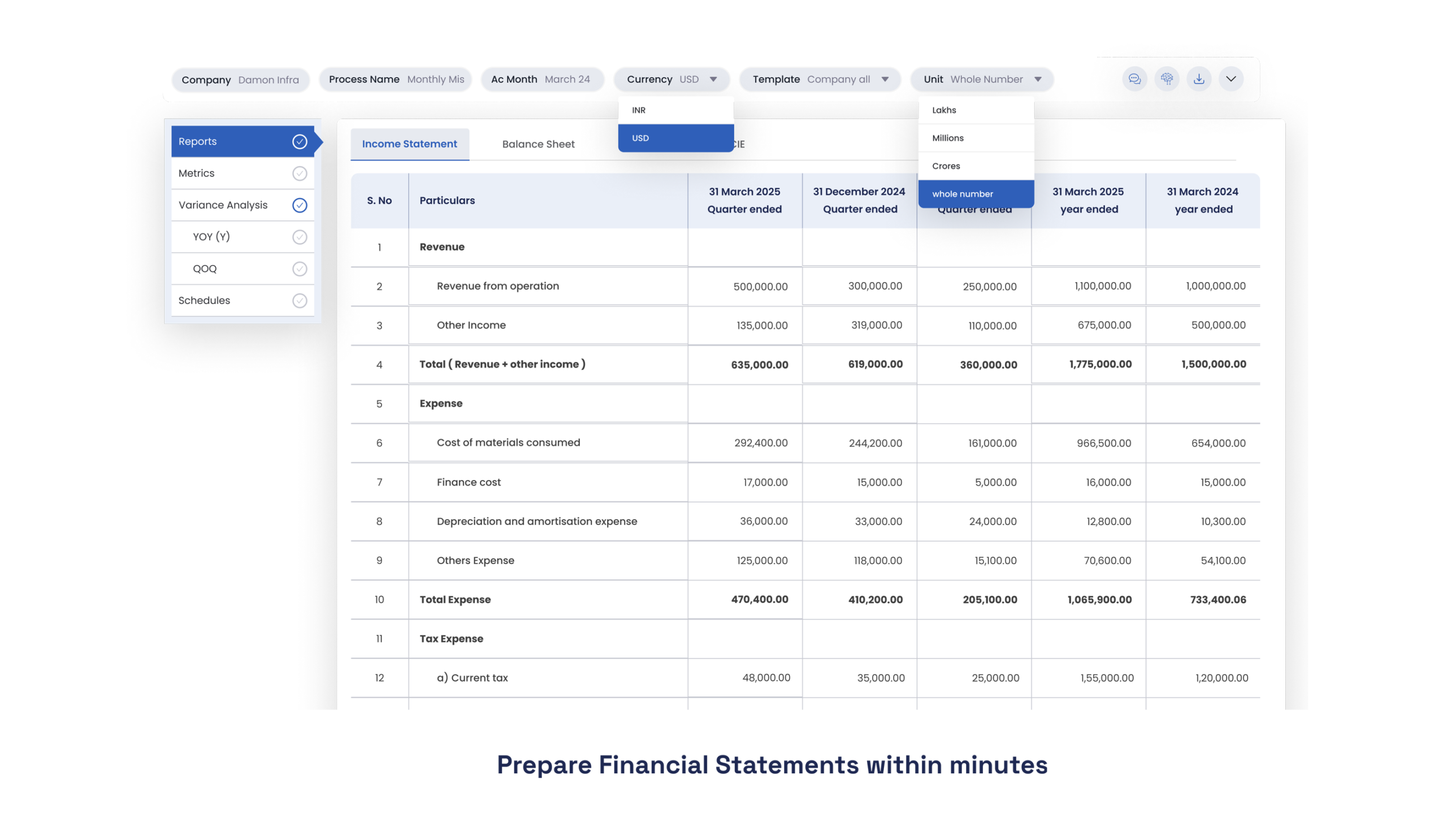

4. Real-Time Reporting and Analytics

Modern finance teams require instant insights. Software that offers real-time dashboards, analytics, and customizable reports allows decision-makers to monitor performance, identify trends, and take proactive actions based on accurate, up-to-date financial information.

5. Audit Trails and Transparency

Maintaining a clear record of every adjustment, approval, and transaction is critical for audits and internal controls. Look for platforms that automatically log all activity, providing complete transparency and audit readiness.

6. Scalability and Flexibility

Organizations grow and evolve over time. Choose financial consolidation software that scales with your business, supporting additional subsidiaries, currencies, and reporting requirements as needed. Flexibility ensures that the platform remains useful as your organization’s complexity increases.

7. User-Friendly Interface

Adoption is critical. Finance teams should be able to navigate the software easily without extensive training. Intuitive dashboards, clear workflows, and simple reporting tools enhance productivity and reduce the learning curve.

Additional Considerations

Beyond core features, organizations should evaluate the following when choosing consolidation software:

* Integration Capabilities: Ensure the platform can integrate seamlessly with existing ERP systems, accounting tools, and other finance applications.

* Security and Data Protection: Financial data is sensitive. Look for platforms with robust encryption, role-based access, and compliance with data protection regulations.

* Customer Support and Training: Strong vendor support, onboarding assistance, and training resources are essential for successful implementation.

* Cost vs. Value: Consider total cost of ownership, including licensing, implementation, and maintenance, relative to the efficiency and accuracy gains provided by the software.

Why Result Lane Excels

Result Lane is a leading provider of financial consolidation software designed for organizations of all sizes. Their platform stands out due to its combination of automation, compliance support, and user-friendly design.

Key advantages include:

* Comprehensive Automation: Streamlines intercompany eliminations, data aggregation, and reporting workflows.

* Compliance Assurance: Built-in IFRS and GAAP support ensures all reports meet regulatory standards.

* Scalable Architecture: Supports multinational operations, multi-currency reporting, and growing business complexity.

* Actionable Insights: Advanced analytics and dashboards empower finance teams to make informed, strategic decisions.

* Secure and Audit-Ready: Complete transparency and robust security protocols protect sensitive financial data.

Implementation Best Practices

To maximize the benefits of financial consolidation software, organizations should adopt a structured approach:

1. Assess Needs: Identify current pain points in data consolidation, reporting, and compliance.

2. Set Objectives: Define measurable goals, such as reduced closing time, improved accuracy, or enhanced compliance.

3. Select the Right Platform: Compare vendors based on features, scalability, ease of use, and support.

4. Plan Data Migration: Ensure clean and accurate data transfer from existing systems.

5. Train Teams: Provide comprehensive training to finance staff to accelerate adoption.

6. Monitor Performance: Continuously evaluate outcomes and optimize workflows for maximum efficiency.

Conclusion

Choosing the right financial consolidation software is a critical decision for any organization aiming to improve financial accuracy, compliance, and operational efficiency. Platforms like Result Lane provide the tools, automation, and insights necessary to streamline consolidation processes, minimize errors, and support strategic decision-making.

By focusing on automation, regulatory compliance, user-friendly design, and scalable architecture, organizations can ensure that their financial consolidation processes are reliable, efficient, and audit-ready. Investing in a robust consolidation platform not only reduces manual workloads but also empowers finance teams to provide accurate, timely insights that drive business success.