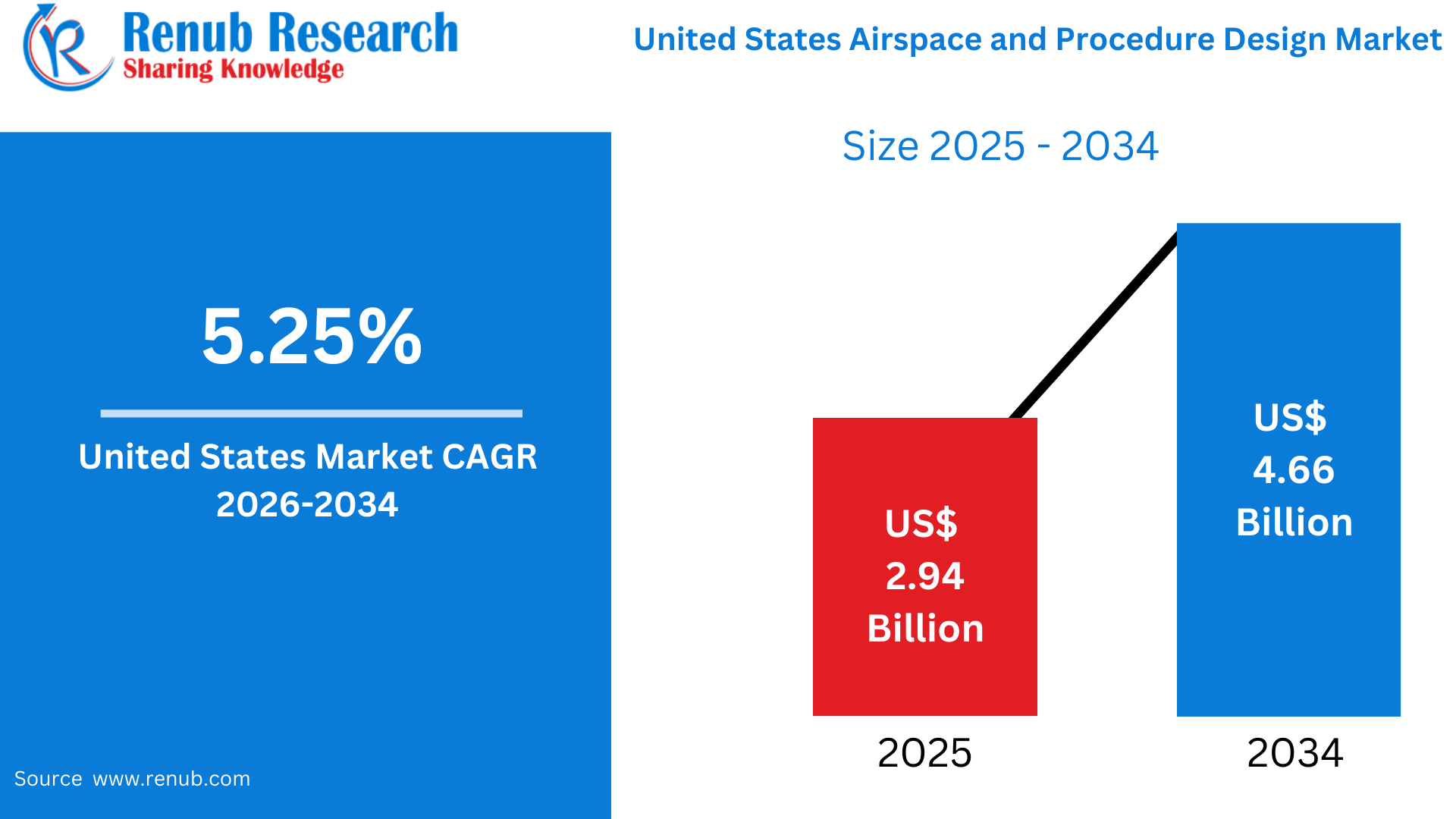

United States Airspace and Procedure Design Market Size & Forecast (2026–2034)

According to Renub Research United States Airspace and Procedure Design Market is projected to grow steadily over the forecast period, increasing from US$ 2.94 billion in 2025 to approximately US$ 4.66 billion by 2034, registering a compound annual growth rate (CAGR) of 5.25% from 2026 to 2034. This growth is driven by the rising volume of aircraft operations, ongoing modernization of air traffic management (ATM) systems, continuous expansion of airport infrastructure, and the accelerating adoption of performance-based navigation (PBN) across civil and military aviation.

As the world’s most complex and heavily utilized airspace, the United States requires constant optimization of airspace structures and flight procedures to maintain safety, efficiency, capacity, and environmental sustainability. The emergence of new airspace users such as unmanned aerial systems (UAS) and advanced air mobility (AAM) platforms further strengthens demand for specialized airspace and procedure design expertise.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-states-airspace-and-procedure-design-market-p.php

Airspace and Procedure Design in the United States: Market Outlook

Airspace and procedure design refers to the planning, structuring, and continuous optimization of controlled airspace and flight procedures to ensure the safe, orderly, and efficient movement of aircraft. This includes air route design, terminal airspace structuring, approach and departure procedures, and PBN-enabled procedures used during different phases of flight. The design process accounts for aircraft performance, terrain, weather conditions, traffic density, safety margins, and environmental considerations such as noise and emissions.

The United States operates one of the busiest and most diverse air transport systems globally, supporting commercial airlines, cargo operators, military aviation, business jets, general aviation, and emerging airspace users. Rising air travel demand, congestion at major hubs, and the integration of new vehicle types have intensified the need for optimized airspace design. Federal and industry-led initiatives focused on digital air traffic management, fuel efficiency, noise reduction, and operational safety continue to reinforce the importance of airspace and procedure design as a critical enabler of national aviation performance.

Growth Drivers in the United States Airspace and Procedure Design Market

Increasing Air Traffic and Airline Capacity Constraints

Rising passenger volumes, expanding air cargo operations, and growth in business aviation are placing significant pressure on the U.S. National Airspace System. Large hub airports face persistent congestion during peak periods, while regional and secondary airports experience variable traffic patterns that challenge existing procedures.

Airspace and procedure design addresses these challenges through route optimization, terminal airspace redesign, and the implementation of efficient arrival and departure procedures. Performance-Based Navigation allows aircraft to fly more precise paths, reduce separation minima, shorten track miles, and improve predictability. These enhancements increase capacity without compromising safety. As airlines focus on improving on-time performance, fuel efficiency, and environmental compliance, demand for advanced airspace and procedure design solutions continues to rise.

Air Traffic Management Modernization and PBN Adoption

The transition from ground-based navigation systems to satellite-based PBN represents a fundamental shift in U.S. air traffic management. RNAV and RNP procedures enable more accurate routing, continuous descent and climb operations, and reduced reliance on traditional ground infrastructure. These benefits directly contribute to lower fuel consumption, reduced emissions, and noise abatement.

Modern procedure development increasingly supports digital ATM functions, data-driven traffic flow management, and collaborative decision-making. With a growing proportion of the U.S. aircraft fleet equipped for PBN and strong institutional commitment to modernization, demand for professional airspace analysis, validation, and implementation services continues to expand. Long-term investments in ATM infrastructure further strengthen market prospects through sustained project pipelines.

Integration of Drones and Advanced Air Mobility (AAM)

Rapid advancements in UAS and AAM technologies are transforming the U.S. aviation landscape. These platforms introduce new operational requirements related to traffic separation, altitude management, and integration with traditional manned aviation. Airspace and procedure design plays a central role in enabling safe coexistence through tools such as geofencing, altitude layering, and dedicated corridors.

As drone operations expand across inspection, logistics, agriculture, and public safety, and as AAM demonstrations progress toward commercialization, demand for specialized airspace design expertise is accelerating. Coordinated national strategies and interagency planning further position airspace and procedure design as a foundational element of future aviation ecosystems.

Challenges in the United States Airspace and Procedure Design Market

Regulatory Complexity and Stakeholder Coordination

Airspace modernization in the United States involves extensive coordination among airlines, airports, air navigation service providers, military authorities, local communities, and regulatory bodies. Implementation of new procedures often requires environmental assessments, noise studies, public consultations, and alignment with diverse operational requirements.

These processes can delay project execution and increase costs, despite strong underlying demand. Balancing efficiency improvements with community concerns and regulatory compliance remains a persistent challenge, requiring long-term planning and collaborative engagement across stakeholders.

Legacy Infrastructure and Operational Constraints

Despite modernization efforts, legacy infrastructure and mixed aircraft equipage continue to limit the full realization of advanced airspace designs. Not all aircraft are equipped to support high-level PBN procedures, resulting in uneven implementation across regions. Integrating new procedures into existing air traffic control systems and operational practices adds further complexity.

The coexistence of legacy and modern systems necessitates design compromises that can reduce efficiency gains. Until fleet equipage and infrastructure upgrades become more uniform, operational constraints will remain a challenge for market growth.

United States Air Route Traffic Control Centers (ARTCC) Market

Air Route Traffic Control Centers play a vital role in managing en-route aircraft operations at high altitudes across long distances. These centers ensure safe separation, efficient routing, and smooth traffic flow between terminal areas. Growth in this segment is driven by rising commercial flights, expanding cargo operations, and increased cross-country air traffic.

Modernization initiatives, including automation technologies, satellite surveillance, and advanced data management systems, are enhancing controller efficiency and safety. Investments focused on delay mitigation, fuel optimization, and capacity maximization continue to strengthen the ARTCC market within the broader airspace and procedure design ecosystem.

United States Air Traffic Control Towers Market

The U.S. air traffic control towers market focuses on managing aircraft movements on and around airport surfaces. Towers oversee takeoff, landing, taxi, and ground operations, ensuring safety within terminal airspace. Market growth is supported by airport expansion projects aimed at accommodating rising passenger demand.

Airports are increasingly investing in advanced tower systems and remote tower technologies to improve situational awareness, reduce congestion, and enhance operational efficiency. These developments reinforce the importance of procedure design at the airport and terminal level.

United States Aeronautical Information Management (AIM) Market

The aeronautical information management market in the United States is expanding due to the shift from paper-based systems to digital information platforms. Accurate, real-time aeronautical data is essential for safe and efficient operations, particularly in PBN-enabled environments.

Airlines, airports, and air navigation service providers rely on AIM systems to support flight planning, airspace management, and decision-making. Increasing airspace complexity and reliance on digital data continue to drive demand for advanced AIM solutions.

United States Airspace and Procedure Design Hardware Market

The hardware segment includes navigation systems, simulation platforms, radar interfaces, flight validation tools, and specialized design workstations. These systems support the development, testing, and validation of optimized flight procedures.

Growth is driven by ATM modernization, satellite navigation integration, and rising airspace complexity. Advanced hardware ensures accuracy, regulatory compliance, and operational reliability, supporting both civil and military airspace design requirements.

Commercial and Military Market Segmentation

The commercial airspace and procedure design market supports airlines and airports in improving efficiency, reducing delays, lowering fuel consumption, and minimizing environmental impact. Rising commercial aircraft traffic, environmental regulations, and PBN adoption continue to drive demand.

The military airspace and procedures design market focuses on supporting training, readiness, and defense operations. Specialized airspace structures and tailored procedures are essential for tactical missions, joint exercises, and unmanned system integration. Modernization of defense aviation assets and civil-military coordination underpin growth in this segment.

Regional Market Insights

California represents one of the most complex airspace markets due to major international airports, dense urban regions, coastal terrain, and significant military operations. Emphasis on PBN, noise abatement, and sustainability drives continuous procedure innovation.

Texas benefits from rapid population growth, expanding airport infrastructure, and extensive military training airspace. Efficient coordination between civil and military authorities is critical to managing high traffic volumes.

New York is characterized by extremely dense air traffic and closely spaced airports, requiring highly precise and synchronized procedures. Noise mitigation and community considerations strongly influence design strategies.

Washington demonstrates strong adoption of innovative and environmentally conscious procedures. Challenging terrain, weather variability, and mixed civil-military operations create demand for sophisticated design solutions.

Market Segmentation Overview

By Airspace:

- Air Route Traffic Control Centers

- Terminal Radar Approach Control

- Air Traffic Control Towers (ATCT)

- Remote Towers

- Aeronautical Information Management

By Component:

- Hardware

- Software

By End User:

- Commercial

- Military

By Geography:

- California, Texas, New York, Florida, Illinois, and the Rest of the United States

Competitive Landscape

The U.S. airspace and procedure design market is highly specialized, with competition centered on technological capability, regulatory expertise, and long-term partnerships. Key companies include Adacel Technologies Limited, Leonardo S.p.A., Frequentis AG, Honeywell International Inc., L3Harris Technologies, Inc., Indra Sistemas S.A., RTX Corporation, Saab AB, and Thales Group. These players compete through innovation, system integration, and compliance with stringent aviation standards.

Conclusion

Overall, the United States Airspace and Procedure Design Market is set for steady growth through 2034, supported by increasing air traffic, ATM modernization, PBN adoption, and the integration of new airspace users. While regulatory complexity and legacy infrastructure present challenges, sustained investment in technology, safety, and sustainability ensures strong long-term demand. Organizations that combine technical expertise with regulatory insight and innovation will remain well positioned in this strategically critical aviation market.